Ctbots.ai January release notes: UI widgets, cross-margin support and new loan logic

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

Before we step into the new year, ctbots.ai team has been working hard on improvements. Our goal remains the same: help users grow their deposit not only in rising markets, but also during downtrends — while making the platform clearer, safer, and easier to use. Below are the latest updates.

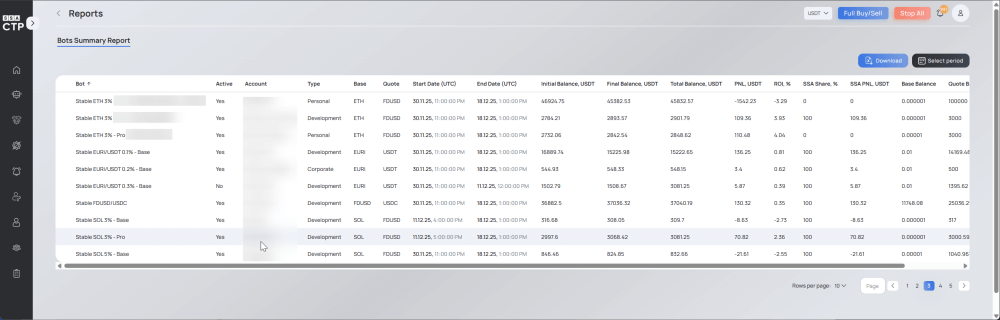

We introduced a new reporting system in the admin panel. It provides statistics for all bots within a selected time period, including how bots behaved and how much they earned or lost. This makes it easier to analyze bot performance, compare results, and spot patterns over time.

Reports can also be exported to an Excel file for further review.

We added the first version of referral tracking. Each user now has a personal referral link in their profile. If someone registers using this link, the system records the connection between the referrer and the new user, and referrals can be reviewed in the admin panel.

At the moment, referral details are available in admin functionality only. In future releases, we plan to make referral tracking visible to users as well.

We improved how balances are displayed. Previously, bot balances were shown only in BTC or USDT. Now, the balance widget can display the balance directly in the bot’s trading currency, for example BNB, FDUSD, or USDT, making it much easier to understand your holdings at a glance.

We refined the “loan” strategy to make repayments smoother and reduce unnecessary costs. Previously, borrowed funds could be used directly for trading. Now, the strategy focuses on payoff first—buying back assets that were previously sold in smaller portions (for example, around 30% at a time), often at lower prices.

When payoff orders are completed, the system automatically repays the loan (auto-repay) without requiring manual action.

We expanded the logic that tracks loan-based trading and introduced three possible outcomes depending on how quickly payoff orders are completed:

This approach helps the bot adapt dynamically and supports the core idea of the strategy: continuing to operate effectively even when prices fall.

To strengthen risk control, we added three cutoff types: PreOverHigh, OverBorrow and OverHigh. These triggers monitor whether the situation moves outside expected boundaries. If a cutoff is activated, the system prioritizes safety by repaying the loan and reducing exposure.

These updates are designed to make ctbots.ai more transparent, user-friendly, and resilient, especially in volatile market conditions. Better reporting improves visibility, UI updates make balances easier to understand, and the strategy improvements add more automation and risk control for loan-based trading.

We’ll continue refining the platform and releasing new features in the coming months, stay tuned for the next updates.

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

November was an incredibly productive month for ctbots.ai. We made significant improvements to our strategy logic, portal functionality, and overall bot performance.

you're currently offline