E-Commerce solution for midsize business: How to choose

How to address the most common issues and uncertainties of medium-sized business when developing eCommerce presence and infrustucture. Check our recent article for valuable insightss!

The software development market in Ukraine contained 285k IT professionals, as of January 2022.

At the end of February 2022, russia launched a full-scale military invasion of Ukraine. From now, market observers have rushed to predict the near future of the Ukrainian tech sector, suggesting a wide range of scenarios from steady high outcomes of the industry to its complete decline. However, as long as hostilities are ongoing, any forecast should be interpreted as pure guesswork.

This war has dramatically affected all sectors of the state economy, and the tech sector is no exception. Yet losses sustained in IT are significantly lower than in any other Ukrainian industry – demonstrating maturity and agility in this sector’s ability to adapt to new realities.

Today, in the fifth month of the war, we see that most software development companies in Ukraine have entirely put themselves on a war footing and are back on track with their projects.

With the aim of highlighting the current IT business environment, we have crafted a brief overview of the local market landscape and of the major trends affected by the ongoing russia’s invasion of Ukraine.

Since the russian hybrid invasion of the eastern Ukrainian regions started in 2014, war was no longer considered implausible in Ukraine. Thus, some local software development companies opened new offices in the western part of the country – or even abroad – long before the commencement of the current war.

In the main part though, even though we were perfectly aware of the threat and took specific measures in advance, what happened on 24th Feb 2022 still caught us off guard.

Though instead of panicking, business managers took up urgent options to ensure the safety of team members and their families. The main task for IT companies at this stage was to transfer their people and, if possible, their assets to the west in safer places and get back to work as soon as possible.

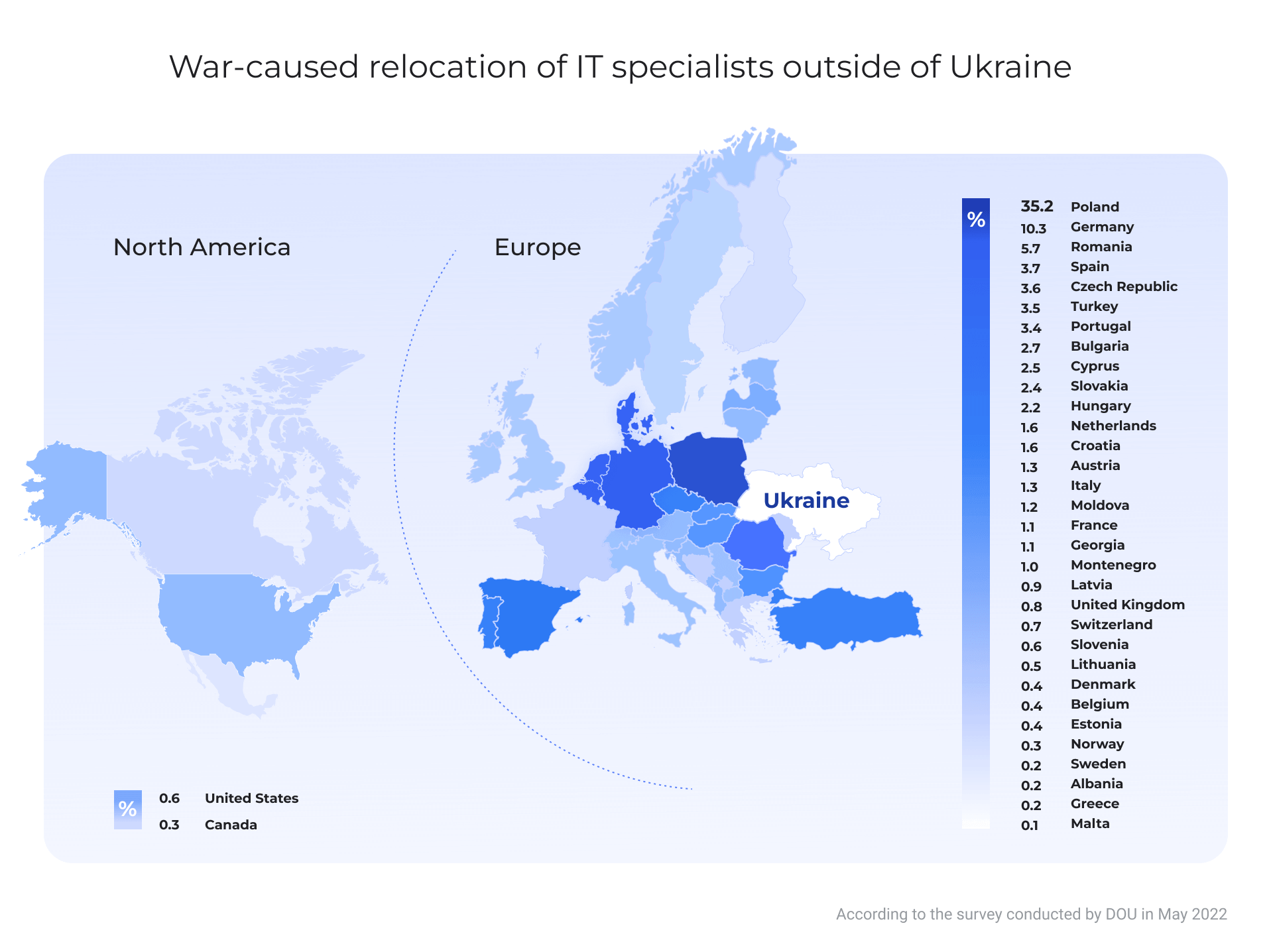

61% of 7000 Ukrainian IT specialists had been forced to leave their homes, as stated in results of the big survey conducted by DOU in the second month of the war:

Over half of the mentioned survey participants consisted of Software Engineers & QA Engineers, mainly working at middle and senior levels (58%). Other departments of Ukrainian software development companies were represented by Design, Marketing Analytics, SEO, Copywriting, DevOps and Data Science. Most of surveyed specialists reported they hadn’t experienced any changes in work due to the invasion.

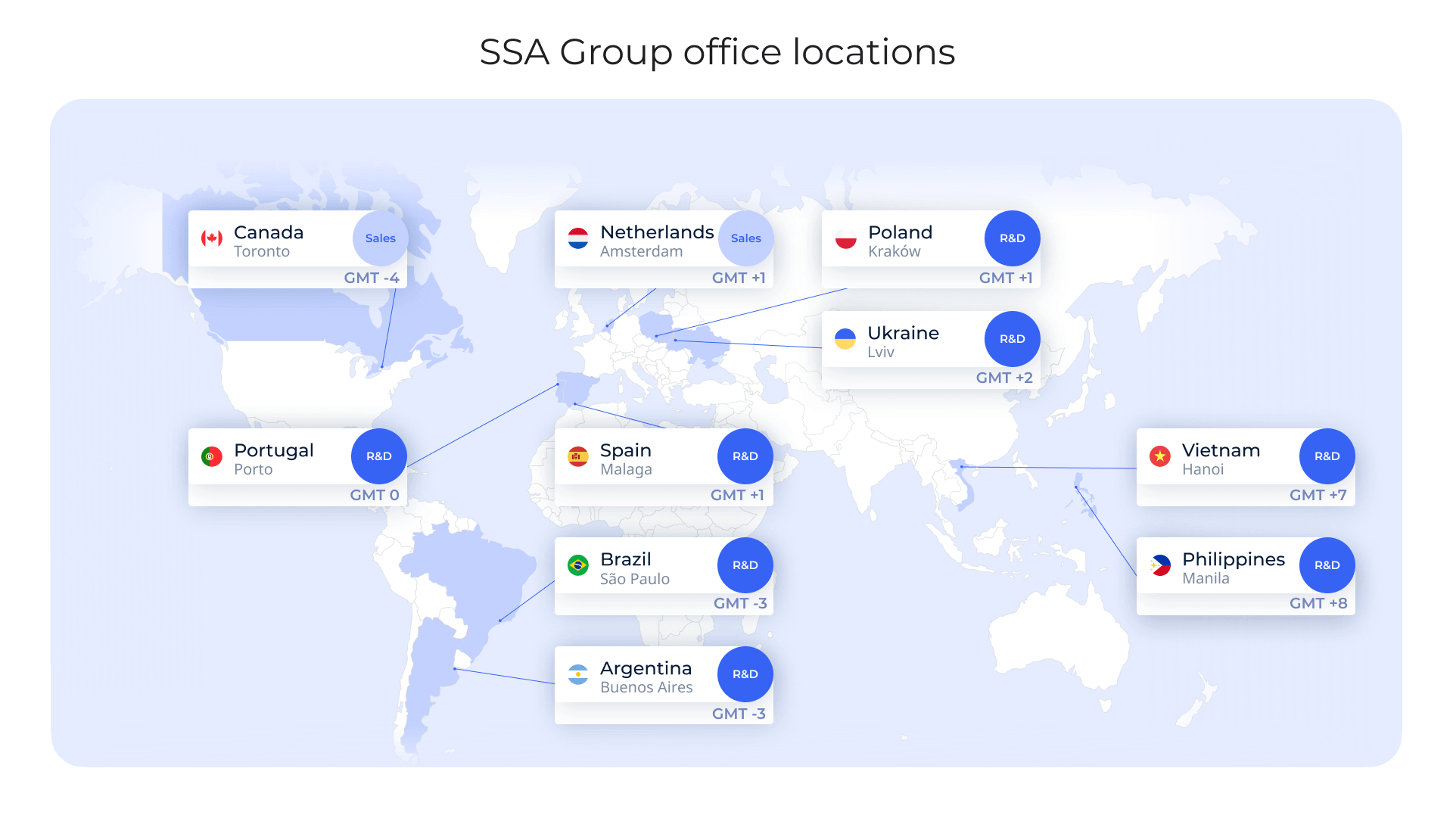

SSA Group has been expanding since 2014 by gradually shifting to the west. In addition to our two locations in north-eastern Kharkiv, new offices were opened in Dnipro, Kyiv, in the centre of our country, and Lviv, in the west of Ukraine.

Just as in other countries, residents of different Ukraine regions vary in their habits, lifestyles, social behaviour and ways of thinking. Thus, aligning a remote workflow with such a diverse crew is not a simple matter and has required steadiness and a thoughtful approach to building internal communication. Since the business expansion was a significant turning point for SSA Group, each of our team members put some effort into making things work smoothly.

Having organised the workflow so that neither distance nor socio-psychological contrasts within the team affected productivity, we started to investigate additional foreign locations, aiming to mitigate risks associated with the potential extension of the war zone in Ukraine.

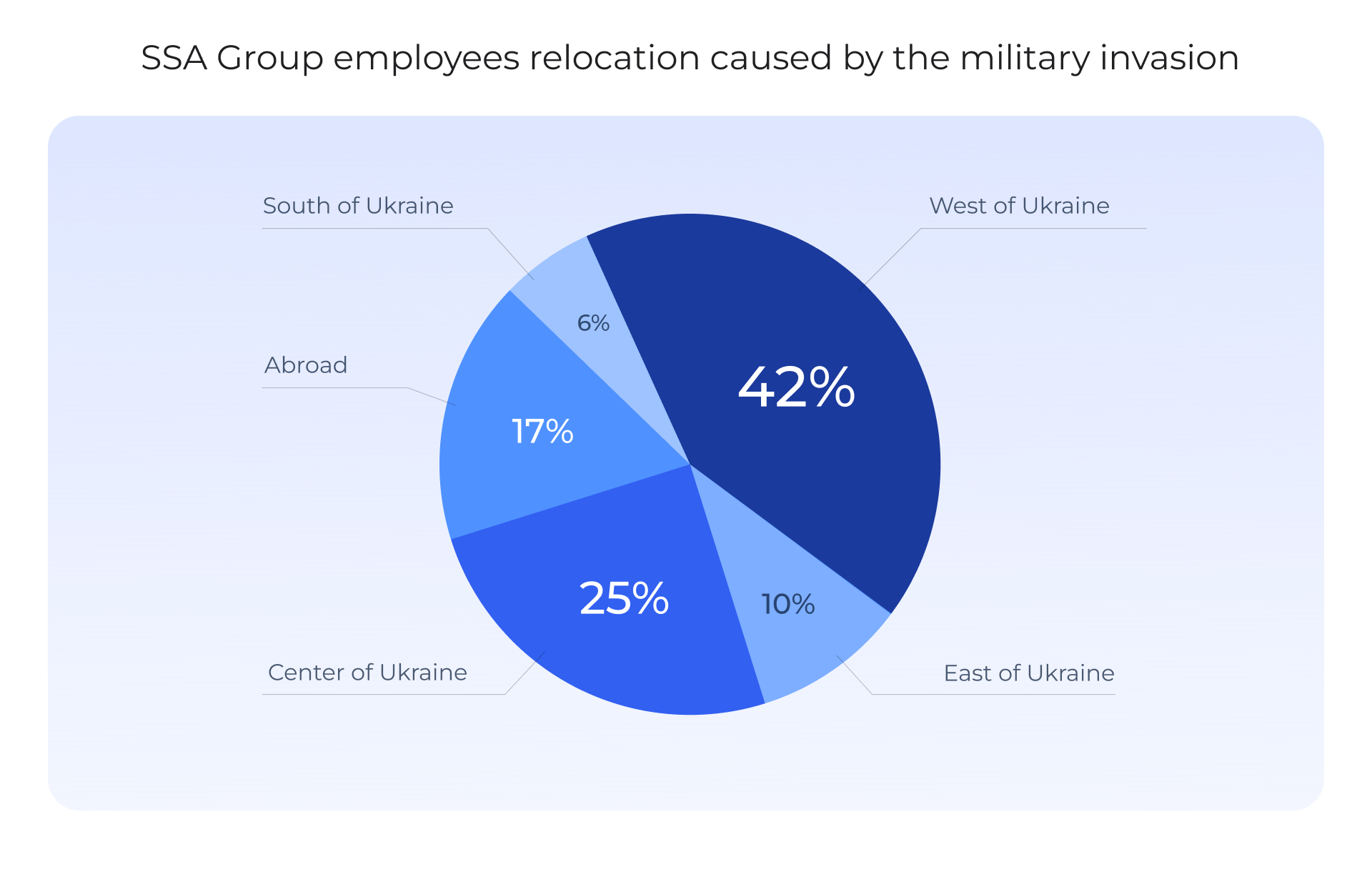

Thus, when the full-scale assault started in February 2022, the SSA Group employees were able to disperse across different regions of Ukraine, and some moved abroad. And our internal statistics look quite similar to the numbers provided by DOU.

The office in Lviv was the only one of our locations to remain open inside Ukraine during the first few weeks of the war. We rearranged the office space and made it available for our employees as a secure shelter in which to work – and live – during wartime. This step also helped us to mitigate the housing issue in the overflowing city of Lviv.

Then, once the tension around the capital subsided, we restored our office in Kyiv. We had also been mapping out a new location for SSA Group in Portugal, and the sudden invasion gave us impetus. Within two months, our new hub in Porto was ready to meet our employees residing there or intending to relocate.

Surprisingly, the lockdown in 2020 proved to be a blessing in disguise for our team. It pushed us to a more flexible and resilient business model to meet the challenges of a new reality with rapidly changing conditions. It also forced us to up our game with a digital transformation strategy and to upgrade our remote workflow management in advance.

The experience we acquired during the pandemic crisis saw us well-prepared for the current emergency caused by the war in Ukraine, despite its unexpectedness.

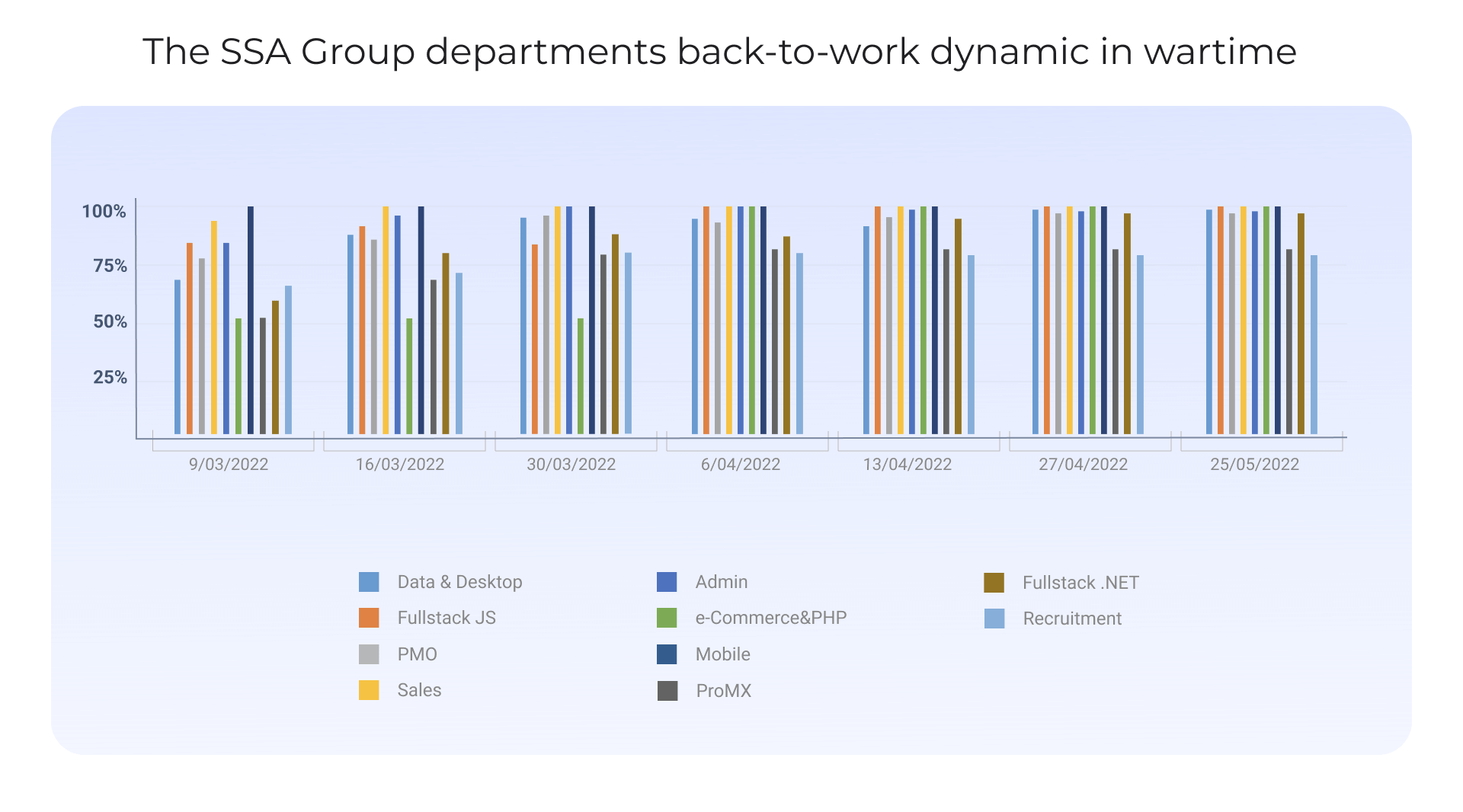

The SSA Group team returned to work smoothly, levelling business losses from the transition period. The war didn’t break our business processes, and the short downtimes were mainly associated with the time required for staff relocation to safer places. A risk reduction strategy we apply gradually is the only one possible in an unforeseen emergency when some risks cannot be avoided.

Many unemployed IT specialists have recently appeared in the Ukrainian labour market because of the war. Ukrainian software development companies targeted the local market, and those who depended on large enterprises were forced to seize the operations down or even to close their business.

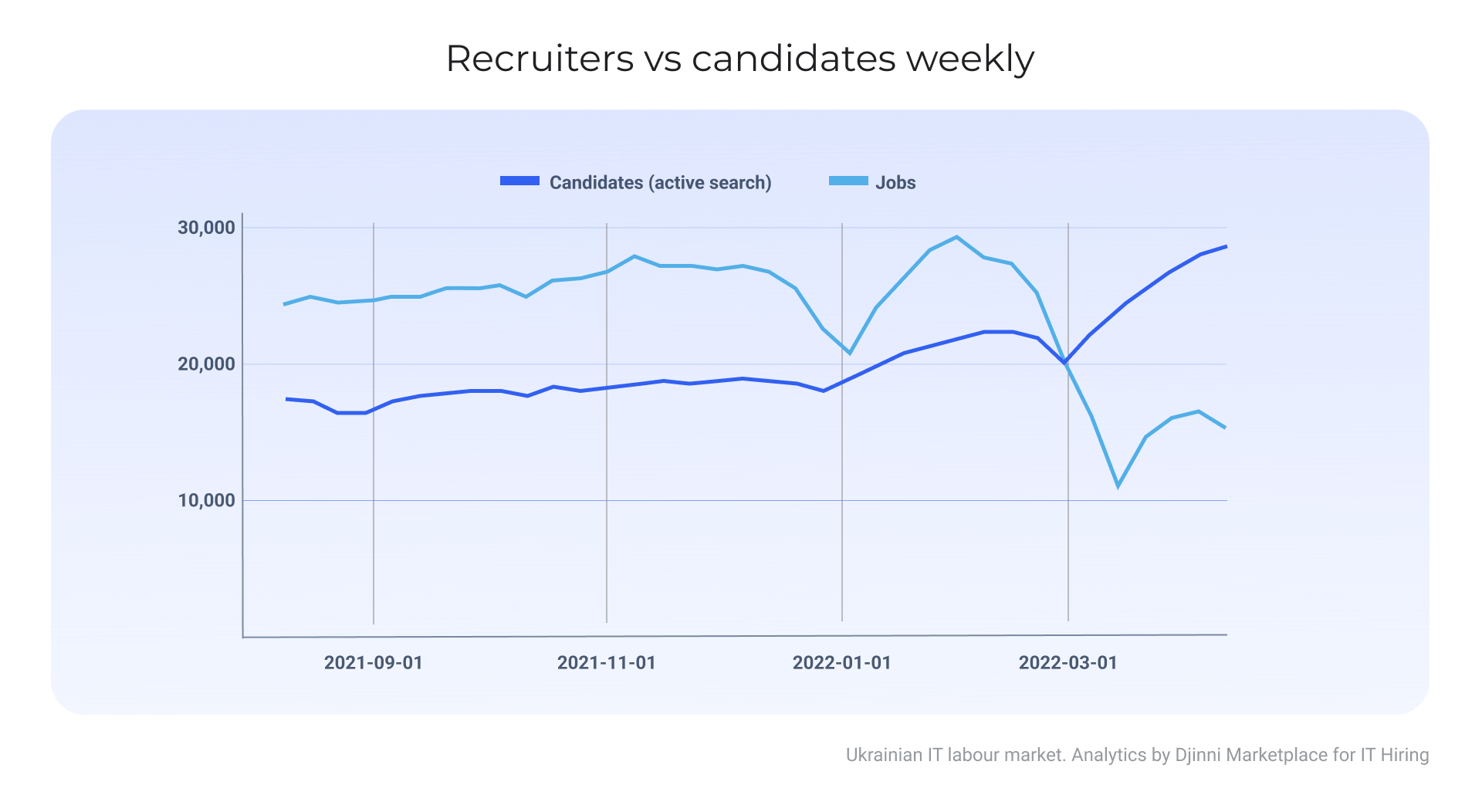

In addition, many professionals engaged in non-IT companies have lost their jobs due to mass sheddings of IT departments. Therefore, a glut of specialists is actively seeking new jobs, creating a gap between supply and demand in the labour market.

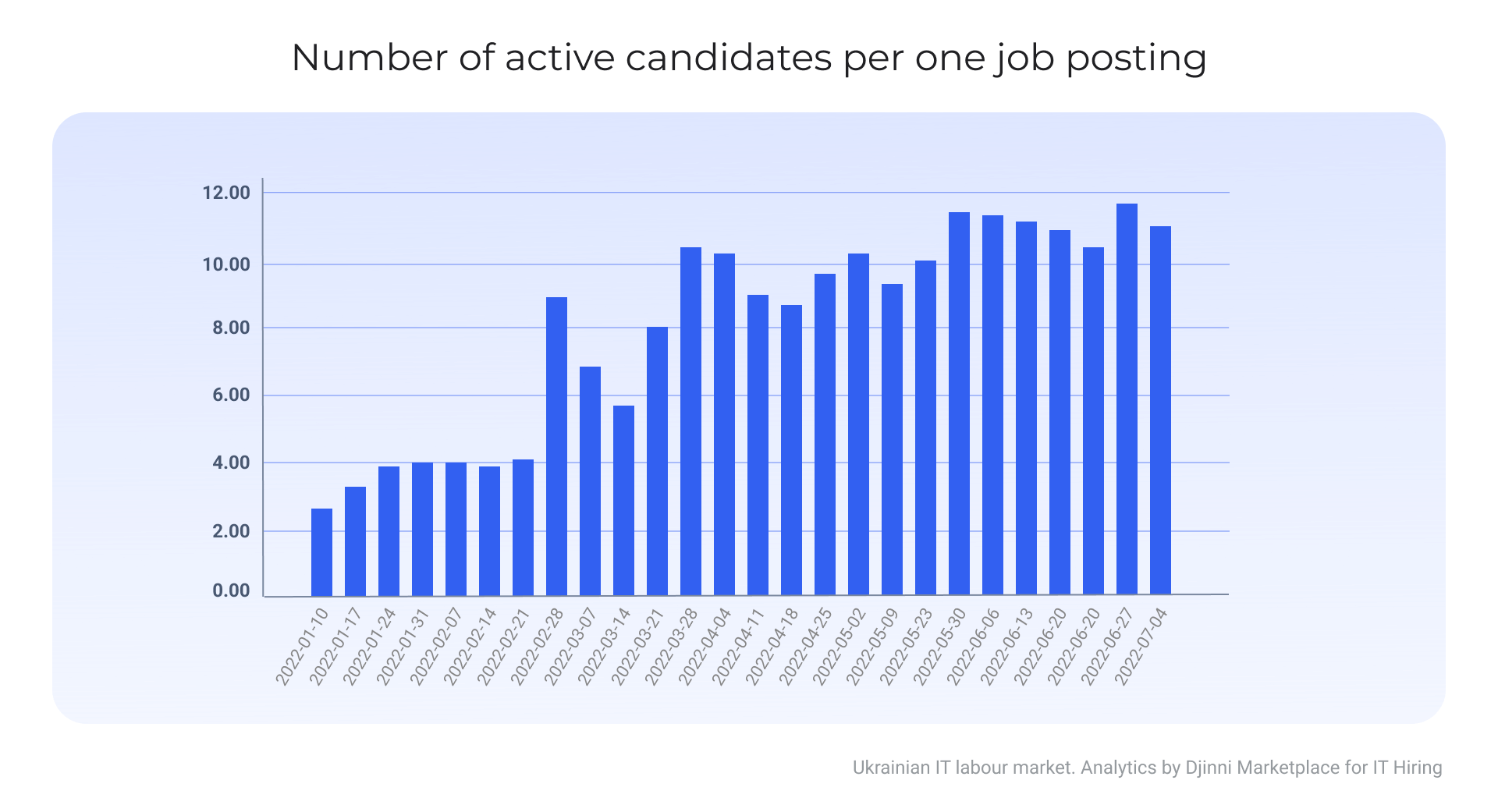

This chart above shows a clear flip from a candidate’s to an employer’s labour market within the industry, and the inflection point shows that it happened precisely within the first days of the invasion.

While the number of job offers decreased 2-2.5 times below the pre-war level, the average number of job applications increased from 3 to 11 candidates per job from January to June.

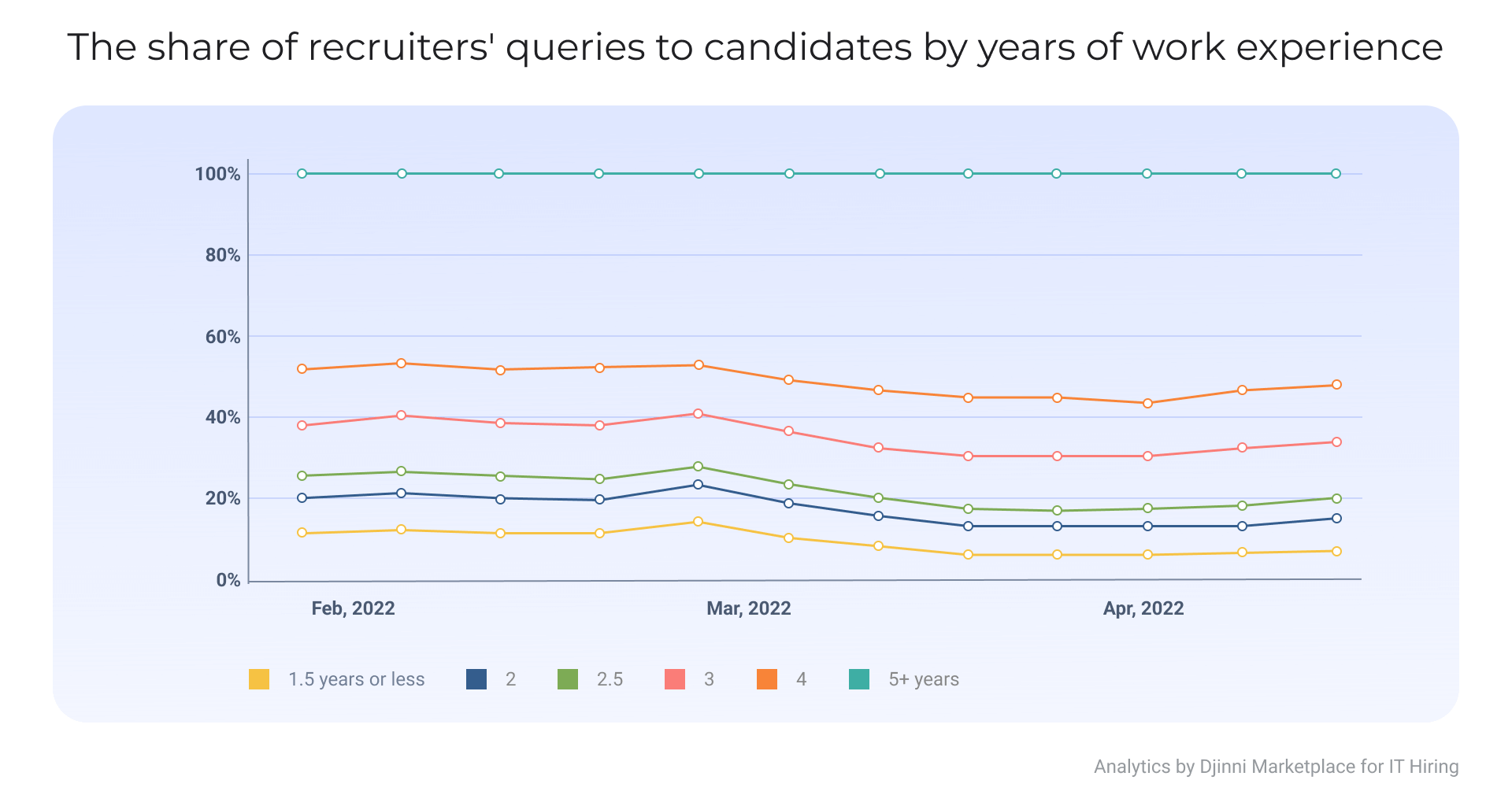

Whilst the total number of candidates in the Ukrainian labour market has increased significantly, highly-skilled specialists are just as rare and in high demand – and the IT market still wants them most of all.

According to DOU, mid-level and senior professionals remain the most sought-after group of employees. The amount of job postings for the most experienced has even increased compared with pre-war indicators.

There has always been an acute shortage of top-level software development specialists with the Ukrainian labour market unable to meet high demand. Employers have therefore been forced to source suitable candidates outside of the country.

However, the SSA Group recruiters recently reported a noticeable increase in appropriate responses to open senior- and middle-level vacancies. Moreover, salaries for top candidates have mostly held up, and these professionals still have options to choose from even in a market where the number of candidates outnumbers recruiters more than six times.

As the survey showed, within the software development market in the second month of the war, the most actively looking for a job were non-engineer professionals: sysadmins, designers, support, and marketing specialists. In contrast, most software developers continued working full-time and stated that they did not intend to change their place of work.

Still, the overall situation in the labour market remains poor. We saw some slight signs of recovery in May, until they were interrupted by the fall of the global investment market. And now, in the sixth month of the war, the IT labour market in Ukraine is still down by 50% compared with pre-war levels. It is still hard to say if this is an emergency flash or a longer-term trend, so the picture could appear more evident in a month or two.

It is no secret that many IT products and services are exported abroad from Ukraine. International clients have reacted rapidly to the recent events in our country by analysing the risks of cooperation with Ukrainian entities during wartime.

Due to the resulting decline in investor confidence, many IT companies in Ukraine have been forced to downsize their operations, some even to close altogether.

Ukrainian software development companies focused on large international corporations were the first to suffer from insurance policies prohibiting any operational activity in high-risk zones. In addition, micro and small IT companies backed by international funds, including many Ukrainian startups, faced the same difficulties.

The current landscape of the Ukrainian IT market may be favourable for medium-sized companies willing to attract high-quality experts to develop and maintain their products. In contrast with large corporations, mid-sized businesses are not bound by strict insurance policies and can still successfully collaborate with Ukrainian IT companies.

Some potential clients may still have concerns about the risk of unforeseen situations. This risk cannot be excluded as the war is still going on in Ukraine and events are of course dynamic by definition. However, we took extensive measures in advance of the current hostilities in order to be able to continue to work on projects with no loss of productivity, even in states of emergency.

We in SSA Group continue increasing our flexibility in international collaboration. Today, despite times of uncertainty, we still deliver full-cycle software development and services worldwide, primarily targeting mid-sized entities, and continue to increase our volume of projects.

Our clients are software product companies, solution providers and specialised IT consultancies in Western Europe, the Nordics, the UK, North America and Australia.

In June 2022, some of our team visited Sweden. This business trip was a vital milestone for SSA Group to define how the ongoing war is affecting our client relations. More than 20 meetings with potential clients were held to discuss joint business opportunities during this trip.

We appreciate the trust and support we found from Swedish businesses, as well as the willingness to build long-term relationships with SSA Group.

Due to the russian invasion of Ukraine, over 40 countries worldwide have sanctioned russia’s financial and economic sectors, the trade of selected commodities, and individuals and entities affiliated with the russian government.

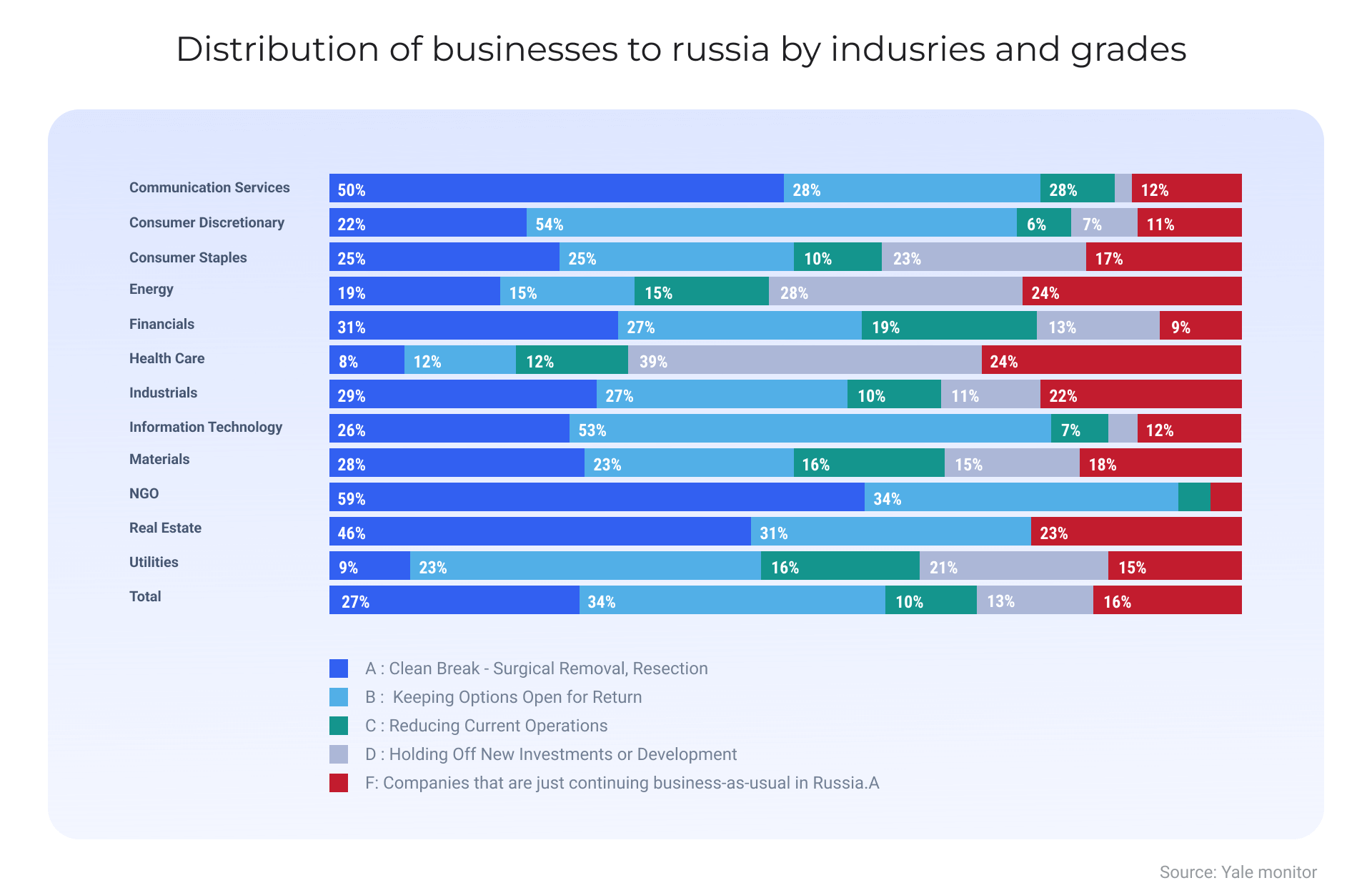

Since February 2022, numerous multinational brands, such as Apple, Microsoft, Google and other international companies have either left the russian market entirely or halted their business there.

The list of enterprises which have terminated operations in russia grew to number nearly 1,000 by early May. Some companies have already withdrawn from projects, while others are in the process of ceasing activity there. It is to be expected some of them may switch from sanctioned entities to Ukrainian service providers.

Since the start of the full-scale military invasion of Ukraine, sanctions and social media bans in russia have significantly impacted its interactive advertising industry. Many global IT companies have also announced the suspension of their activities in russia. Amongst them was Dell, which generated approximately 59.94 billion russian rubles in the country in 2021.

SSA Group ceased all cooperation with consultants and contractors from russia in 2014.

Following the full-scale invasion of Ukraine in February 2022, we also terminated any partnerships with entities residing in belarus. We have no current or planned cooperations with companies based in russia or belarus, or those founded by russian or belarus citizens. SSA Group only partners with clients who share our position.

If you have previously worked with a russian or belarus software development team and are now looking for a new vendor, please feel free to contact SSA Group experts for professional consultancy on the delivery of your project.

Two contrary trends persist in the world market today.

The first and the most obvious is that the world economy is facing unprecedented inflationary pressures. According to the World Bank’s latest report, global inflation is predicted to reach 7.9% in 2022, compared to the average annual indicator of 3.8% between 2001-2019.

The second trend is the decrease in the value of assets of global companies due to rising interest rates and efforts to claw the worldwide economy back from the effects of the pandemic.

Despite the general trend being affected by the pandemic recession and the return of people and businesses to previous offline behaviour, these are not key factors for the tech sector.

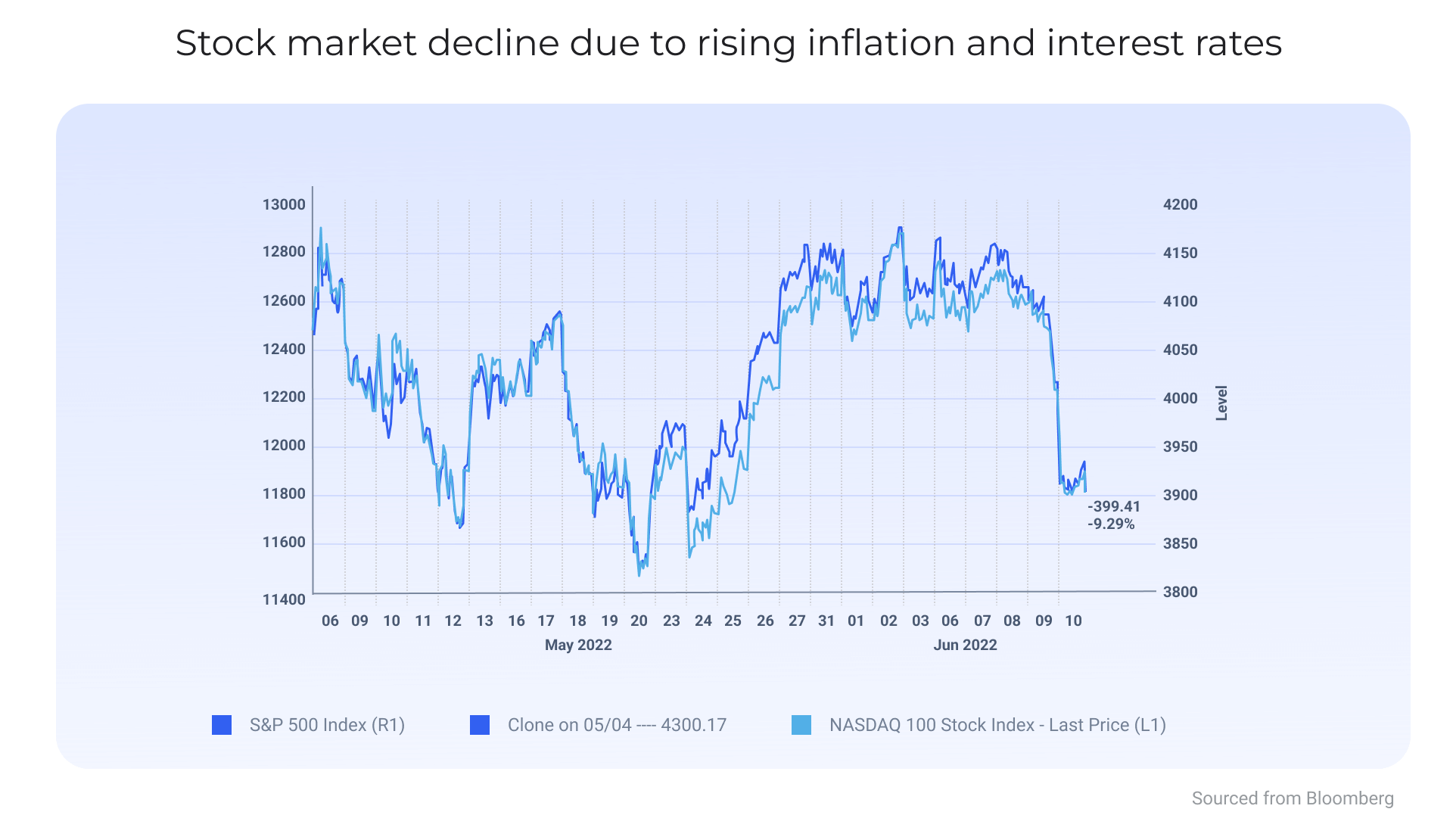

Large technology companies are, however, especially vulnerable to rising interest rates. Thus, the day after the Federal Reserve announced its decision to increase the benchmark interest rate in May 2022, the stock market collapsed.

Even the FAANG companies, whose shares had been growing steadily for the past several years and reached sky-high levels during the pandemic, experienced a significant decline. The resulting exodus of investors looking for safer investments has deprived funding to numerous tech projects and startups.

The full-scale russian invasion of Ukraine has triggered a devastating humanitarian crisis in Europe, pushing prices up, slowing growth globally, and exacerbating inflationary pressures in worldwide economies. It has also impacted global energy prices, setting tighter financial conditions that will weigh on all financial markets and placing energy security at the heart of investor interest.

In these market conditions, the war in Ukraine acts as an additional catalyst, accelerating both inflationary and asset depreciation trends, and hastening their effects. russia’s ongoing aggressive intentions have multiplied global uncertainty and made accurate forecasting impossible.

SSA Group has been present in the Ukrainian market for about 15 years, a period which could hardly be called calm. Yet despite a number of challenges, including the deep economic crisis in 2008, devaluation of the national currency in 20xx and much more turbulence during and since, we not only remained afloat but have grown and progressed our company.

Years of global pandemic and ongoing war have changed our perception of shocking events and forced us to accept uncertainty as the new normal. Our team has learned to adapt rapidly to a dynamic and changing environment whilst maintaining productivity.

The SSA Group team can clearly see the way forward and is on a dedicated path to growth. We consider flexibility, readiness to innovate, and the proper surroundings to be the keys to wealth in tough times. Loving what we do, being hardworking, and ready to move fast in handling new challenges, we have every reason to remain optimistic about the near future.

If your project requires experiencesed professionals, striving each time for the best possible solution, we are here to meet your expectations. Please feel free to drop a line to the qualified IT advisors of SSA Group.

–

How to address the most common issues and uncertainties of medium-sized business when developing eCommerce presence and infrustucture. Check our recent article for valuable insightss!

This article explains how to build appropriate cooperation and communication between project stakeholders to mitigate risk and achieve the expected project outcomes.

you're currently offline