Smarter tracking. Stronger stability. Greater potential — CTP and ctbots.ai February update

Throughout February, we continued enhancing SSA CTP and ctbots.ai — making them more transparent, more stable, and easier to analyze.

November was an incredibly productive month for ctbots.ai. We made significant improvements to our strategy logic, portal functionality, and overall bot performance. Let’s take a closer look at what’s new.

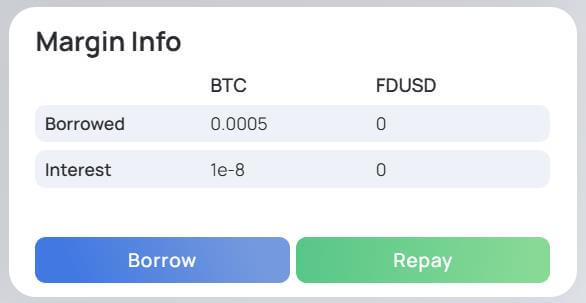

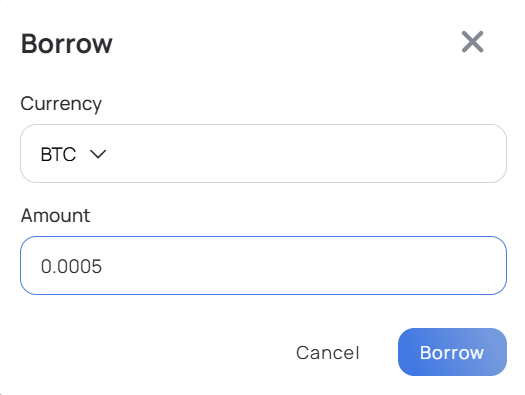

We’ve introduced a powerful new feature designed especially for falling market conditions. When the market enters a downward phase and meets certain criteria, the bot can now automatically determine the most favorable moment to borrow funds.

You can use this feature automatically or manually through the portal interface, giving you more flexibility and control.

When the bot exits the falling mode, the borrowed funds are automatically repaid.

Users can already top up and withdraw funds — now we’ve made it easier to track balance activity.

The new Balance History interface allows you to clearly see all balance adjustments, ensuring accurate PnL tracking that fully reflects your fund movements.

As announced earlier, we’ve officially launched the expanded order capacity. Bots can now operate with 160–200 orders, doubling their precision.

This enhancement significantly boosts performance by:

We’ve added support for Ed25519 encryption for Binance API integration keys.

This new API format is:

It ensures a higher level of protection and reliability when connecting your Binance account.

These updates mark another important step in improving both the intelligence and flexibility of ctbots.ai. We’re committed to making our platform more powerful, more secure, and easier to use — and we look forward to sharing even more exciting updates soon.

If you have any questions or feedback, feel free to reach out.

Throughout February, we continued enhancing SSA CTP and ctbots.ai — making them more transparent, more stable, and easier to analyze.

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

you're currently offline