November product update: What’s new at ctbots.ai

November was an incredibly productive month for ctbots.ai. We made significant improvements to our strategy logic, portal functionality, and overall bot performance.

Welcome back to our journey through the exciting world of crypto trading bots! In our previous blog entries, we explored the foundational crypto terms, uncovered the inner workings of trading bots, and delved into various strategies—including the innovative ones we offer here at ctbots.ai. If you missed those, we highly recommend checking them out to get the full picture.

Today, we’re diving deeper—this time into the types of bots available on ctbots.ai, how they differ, and the key performance metrics that will help you evaluate and choose the best one for your goals and risk appetite.

So grab your favorite brew, settle in, and let’s explore.

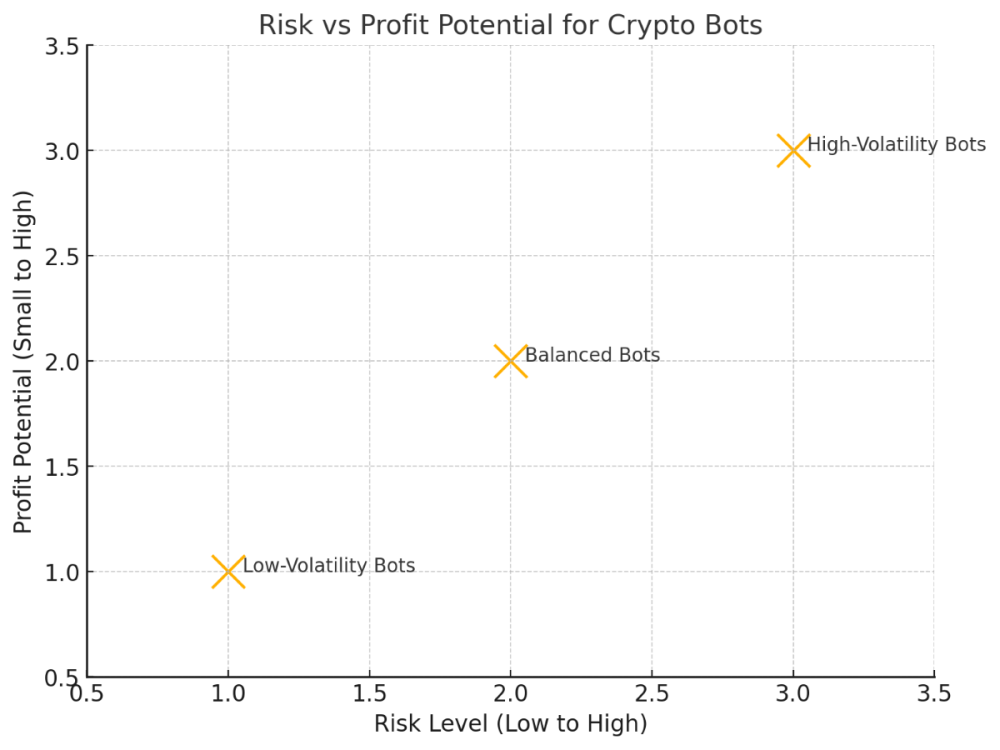

At ctbots.ai, we’ve grouped our bots into three core categories based on market volatility and trader risk preference. Each type serves a distinct purpose and is designed to support different styles of trading—from slow and steady to fast and aggressive.

What they do:

These bots operate in calm, stable markets—often trading well-established coins like USDT, USDC, FDUSD, USDE during quiet periods. They aim for gradual and consistent profits with minimal exposure to sharp market swings.

How they behave:

Example:

Think of a bot trading USDT when it hovers around $1 during flat market phases.

The outcome:

What they do:

These bots walk the fine line between security and opportunity. They’re designed to optimize returns without diving into excessive risk—ideal for traders who want moderate growth without wild fluctuations.

How they behave:

Example:

A balanced bot might alternate between TRX, BNB, EURI and base versions of more volatile currencies like USDC or USDT.

The outcome:

What they do:

These bots are engineered for action. Operating in high-volatility markets, they chase rapid price movements and thrive on momentum. Ideal for experienced traders who understand the game—and the stakes.

How they behave:

Example:

A bot trading meme coins, micro-cap tokens, or trending altcoins with 20–30% daily movement.

The outcome:

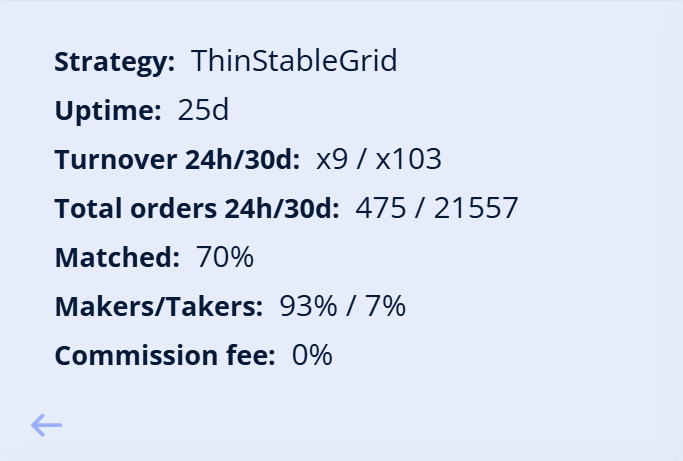

To properly assess a trading bot’s performance and determine if it fits your specific trading objectives, it’s crucial to have a solid understanding of several key performance metrics. At ctbots.ai, we make this process seamless by setting the standard essential indicators clearly displayed for each bot, allowing you to make informed, confident decisions.

Here’s what to look for:

It also reveals the bot’s “X factor”—a multiplier indicating how many times the bot turns over its available balance within the given timeframe. A higher turnover rate means the bot is actively cycling funds through the market, offering insights into its aggressiveness and market engagement.

This metric is especially useful for evaluating how dynamic or passive a bot is, helping you align its behavior with your desired trading pace.

Makers add liquidity to the market by placing limit orders, often resulting in lower fees. Takers remove liquidity by using market orders, typically incurring higher costs.

A higher maker ratio generally indicates greater cost efficiency, making this metric especially important for high-frequency or fee-sensitive strategies. It offers valuable insight into how effectively the bot is managing trading expenses.

Whether you prefer slow and steady growth, a balanced approach, or high-speed thrills, there’s a bot at ctbots.ai designed just for you.

By combining transparent metrics, powerful strategies, and an ever-evolving toolkit, we help you navigate the crypto markets with confidence and clarity.

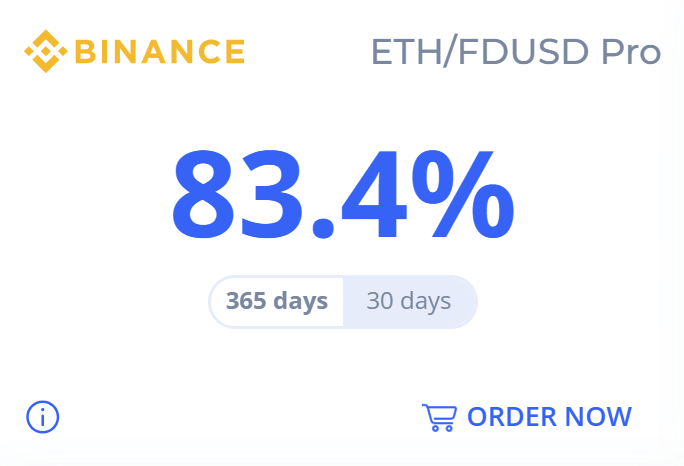

To help you stay on top of what’s working, we post weekly updates in our Telegram channels showcasing the top-performing bots in each category, along with key performance metrics:

Ready to unlock smarter, stress-free trading?

Join ctbots.ai—where innovation meets simplicity.

November was an incredibly productive month for ctbots.ai. We made significant improvements to our strategy logic, portal functionality, and overall bot performance.

Over the past two months, the ctbots.ai team has been working intensively to enhance our trading strategies and platform functionality.

you're currently offline