Ctbots.ai January release notes: UI widgets, cross-margin support and new loan logic

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

The world of crypto trading is evolving rapidly—and so is ctbots.ai. This July, we’re excited to roll out enhancements that make our platform smarter, faster, and even more aligned with market realities. Whether you’re a seasoned trader optimizing your strategy or a newcomer exploring automated trading, these updates are designed to offer more control, better responsiveness, and greater efficiency.

Here’s what’s new this month.

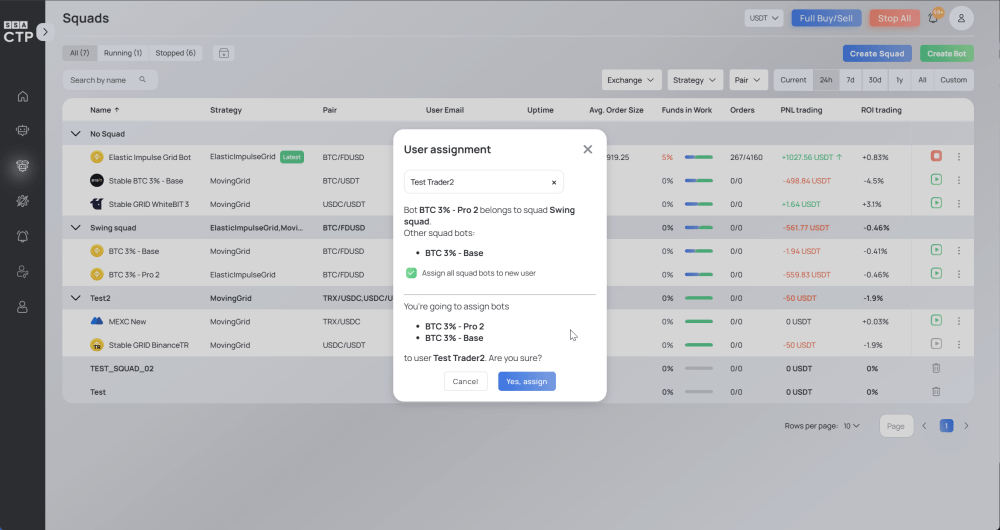

We’ve introduced an essential improvement for platform administrators: the new “Assign to User” feature.

Previously, we introduced a stop-loss protection mechanism, which triggers a sell-off if the bot detects persistent price drops—helping you secure funds in stablecoins before a deeper fall.

Now, we’ve added a proactive counterpart: the early bird purchase mechanism.

This strategy upgrade allows our bots to recognize upward price trends early and adapt the trading range dynamically, enabling quicker entries during bull runs. Instead of waiting for prices to rise beyond a set threshold, the bot now adjusts on the go—buying as the trend builds.

Another major shift: bots now use a dynamic approach to reinvest profits.

Previously, buy/sell amounts were fixed. Now:

Let’s break it down with a relatable example:

You start with $1,000 and buy 10 tokens at $100 each.

The price rises to $200 per token, so you sell for $2,000—doubling your funds.

The price dips back to $100, and now you reinvest the full $2,000, buying 20 tokens.

Even with small price movements, this frequent buy-sell cycle amplifies returns over time through smart reinvestment and adaptive trade ranges.

Based on geometric progression, this strategy works well not just in booming markets, but also in flat or falling conditions where micro-movements can be captured frequently.

The July update brings powerful improvements that elevate both the usability and intelligence of ctbots.ai. From streamlined admin features to more adaptive trading strategies, these changes are designed to help traders respond faster and operate more efficiently—whether you’re managing a team or trading solo.

Our new dynamic trading logic and capital reinvestment flow allow bots to react early, frequently, and strategically—enabling better results in both trending and stable market conditions.

👉 Ready to try the new features? Visit us at ctbots.ai to learn more.

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

Before we step into the new year, ctbots.ai team has been working hard on improvements. Our goal remains the same: help users grow their deposit not only in rising markets, but also during downtrends — while making the platform clearer, safer, and easier to use.

you're currently offline