Ctbots.ai January release notes: UI widgets, cross-margin support and new loan logic

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

So, you’ve explored different paths into crypto trading and decided to go with a smoother, more automated approach — crypto trading bots. You’ve read up on trading fundamentals, learned about strategies, and even got familiar with essential bot parameters. But one question still lingers: What makes a crypto bot truly perfect?

In this article, we’ll walk you through the most critical bot performance indicators — based on SSA Group’s standards — to help you choose or build a bot that’s not just functional, but exceptional.

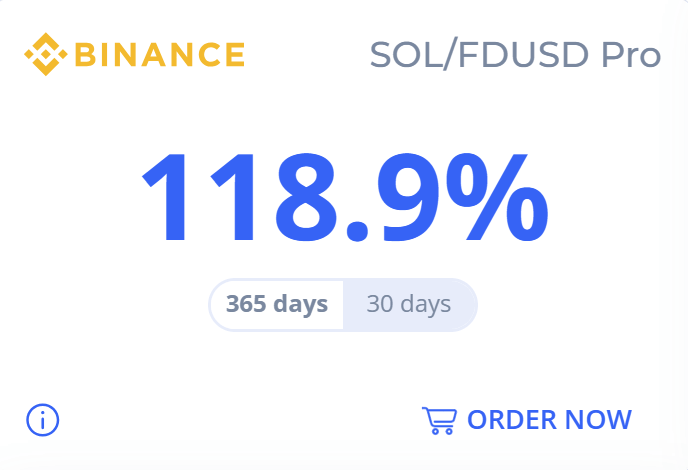

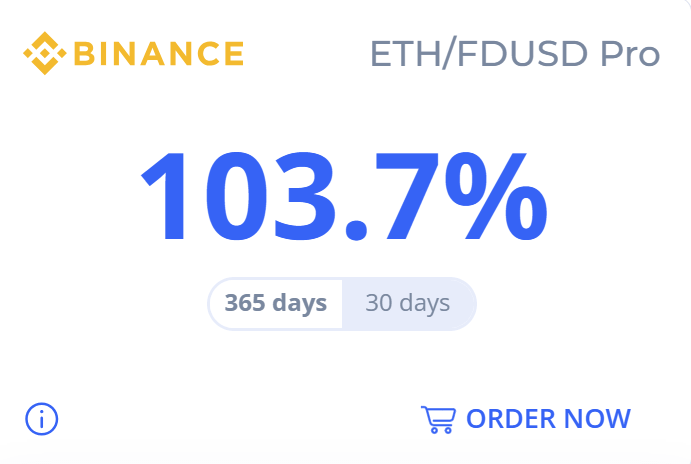

Profit and Loss (PnL) is undoubtedly one of the most critical metrics for evaluating a crypto trading bot’s success. While the ideal profitability range varies depending on the bot category, there are practical boundaries to consider. Bots generating less than 5% annual return are typically not worth the effort, while those promising over 200% annually often signal excessive risk or unrealistic expectations. Striking a balance between ambition and sustainability is key to long-term success.

On a monthly basis, a healthy PnL would be approximately 1% for low-volatility bots and 10–15% for high-volatility bots, reflecting the different levels of risk and reward.

Below are some examples of bots available at ctbots.ai that consistently demonstrate strong and reliable PnL performance.

What it is:

Uptime measures how long the bot has been running without interruption. It reflects the bot’s reliability, infrastructure stability, and resilience against crashes or disconnects.

Why it matters:

High uptime builds trust. A bot with 12 months of uninterrupted operation is considered battle-tested. But even a consistent 3-month runtime is a strong indicator of dependable performance.

Rule of thumb: Look for at least 90 consecutive days of stable uptime before trusting a bot in live environments.

What it is:

This metric shows the total trading volume managed by the bot over 24 hours and 30 days. It’s a reflection of the bot’s activity level, and, indirectly, its ability to spot and act on opportunities.

What’s ideal:

The higher the turnover (within safe risk limits), the more aggressively and productively your bot is engaging with the market.

What it is:

This percentage indicates how many of the bot’s placed orders were successfully executed — a key marker of how well the bot times and places trades.

What’s perfect?

Context matters — always evaluate this metric in relation to the bot’s role in a multi-bot strategy.

What it is:

This ratio compares limit orders (makers) vs market orders (takers). Makers provide liquidity and usually come with lower fees, while takers consume liquidity and typically cost more.

What’s ideal?

A high maker ratio shows the bot is cost-aware and structured for efficient trading.

Crypto exchanges like makers and engage them in every way — through low fees for maker bots and even rebates in some cases. Choosing exchanges with these features can further enhance bot profitability.

What it is:

Tracks how much of your bot’s earnings are lost to exchange fees.

Why it matters:

In active trading, even tiny inefficiencies compound quickly. If your bot’s strategy yields 2% profit per day but loses 0.5% in fees, you’re losing a quarter of your gains.

What to aim for:

Always account for fees in your bot’s profitability model — gross returns don’t tell the whole story.

Choosing a perfect crypto trading bot means understanding the metrics that define one — and knowing which values truly reflect performance, efficiency, and safety.

Here’s a quick summary of SSA Group’s performance benchmarks for an ideal bot:

| Parameter | Ideal Value |

| PnL | Higher than 5% annually, but not exceeding 200%; 1% monthly for low-volatility bots; 10–15% monthly for high-volatility bots |

| Uptime | 3 months minimum; 12+ months = excellent |

| Turnover 24h/30d | 10x daily minimum / 30–40x = excellent |

| Matched orders % | 60%+ (Pro bots), 2%+ (Base bots) |

| Makers vs Takers | 100% makers preferred |

| Commission fee % | < 0.1% per trade |

To sum up, to balance risks, it is wise to have several bots from different categories: low-volatility, balanced, and high-volatility. Of course, it might be hard to reach ideal values for all parameters in one bot. So here is a smart-trader hint for you — the solution lies in choosing good bots from each category (or more than one from the same category). Through diversification, you can approach a near-perfect overall strategy.

Here are examples of bots from different categories we have at ctbots.ai that you can include in your bot portfolio and increase your gains:

Low-volatility bot

Balanced bot

High-volatility bot

But if you have your own strategy and would like to implement it with crypto bots trading, SSA Group can develop your own custom bots within SSA Crypto Trading Platform.

Want help tailoring or evaluating your crypto bot using described metrics? SSA Group team is here to guide you.

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

Before we step into the new year, ctbots.ai team has been working hard on improvements. Our goal remains the same: help users grow their deposit not only in rising markets, but also during downtrends — while making the platform clearer, safer, and easier to use.

you're currently offline