Ctbots.ai January release notes: UI widgets, cross-margin support and new loan logic

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

Over the past two months, the ctbots.ai team has been working intensively to enhance our trading strategies and platform functionality. We’re now excited to share the latest updates that make our bots even more adaptive and intelligent.

We’ve added a brand-new Falling mode, designed specifically for markets showing a downward trend.

When the system detects falling conditions, it automatically switches bots from standard mode to Falling Mode. This mode operates within a price range twice as wide as the regular one.

In standard mode, orders are placed both above and below the root price. In Falling mode, however, orders are placed below the current market price, meaning the bot trades only in the lower range – anticipating a continued decline.

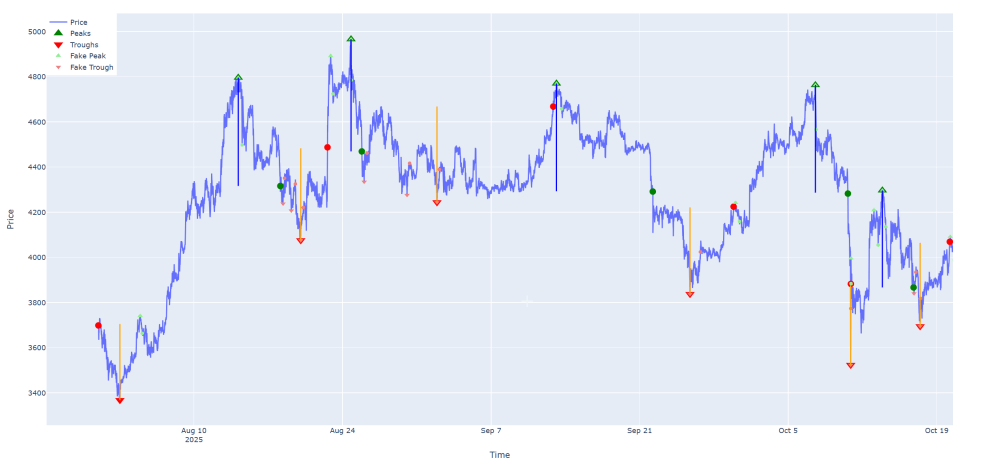

To determine when to activate Falling Mode, we’ve introduced two key concepts: peaks and troughs – representing local maximums and minimums on the price chart over a defined period.

The system enters Falling Mode only when specific criteria are met. For instance, when a peak is clearly identified on the price graph, signaling a potential downward trend.

To refine these detections, we also use the concepts of span and break:

These thresholds help us distinguish genuine market reversals from short-term fluctuations (or “fake” peaks/troughs). Think of it as a helicopter view of price trends over time, enabling better trend recognition and decision-making.

You can see the strategy illustrated in the image below.

This approach allows the system to predict long-term market trends and automatically choose the optimal bot setup – Standard mode for growth periods or Falling mode for downward trends.

Our next enhancement to Falling mode will introduce a funds loan feature, allowing bots not only to preserve capital but also to increase earnings potential during bearish conditions.

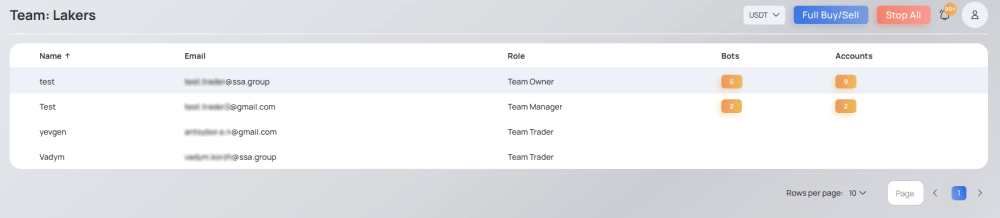

We’re also excited to announce the launch of Team functionality – a major improvement to collaboration and management within ctbots.ai.

Each team can include members with specific roles:

Team Owners can also send team invitations, making onboarding quick and effortless.

Our CTP control mobile app, developed using the SSA Group’s proprietary Mobile kit, is now available in both the App Store and Google Play.

You can learn more about this update in our earlier post on SSA Mobile kit.

Our next major goal is to expand bot order capacity from 80 to 160–200 orders per bot. This will allow for a wider operational range, more trading activity, and ultimately higher turnover and profit potential.

Ctbots.ai continues to evolve – combining advanced algorithms, market analytics, and flexible bot management to help you stay ahead of every market trend. Stay tuned for more innovations soon!

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

Before we step into the new year, ctbots.ai team has been working hard on improvements. Our goal remains the same: help users grow their deposit not only in rising markets, but also during downtrends — while making the platform clearer, safer, and easier to use.

you're currently offline