Smarter tracking. Stronger stability. Greater potential — CTP and ctbots.ai February update

Throughout February, we continued enhancing SSA CTP and ctbots.ai — making them more transparent, more stable, and easier to analyze.

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer. January was focused on making account management clearer, trading costs more transparent, and bot strategies more flexible across different market conditions. Below is a quick overview of the latest ctbots.ai updates.

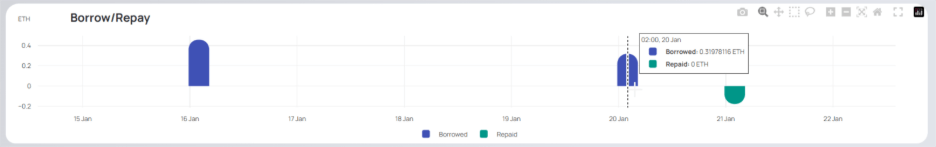

We introduced a new Borrow/Repay widget that allows users to track when loans were taken and when repayments were made. This provides clearer visibility into borrowing history and simplifies monitoring of leveraged activity.

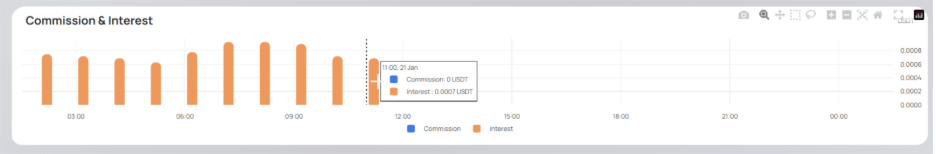

To improve cost transparency, we added dedicated Commission and Interest widgets. When funds are borrowed, these widgets display the hourly interest charged by the exchange, making it easier to understand and evaluate borrowing costs in real time.

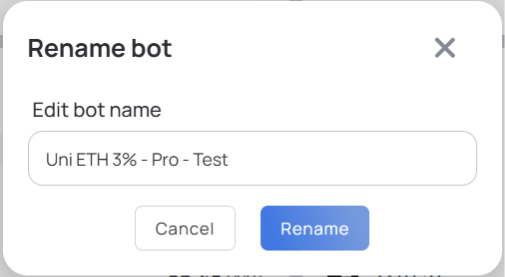

Account administration is now more convenient with the new bot renaming feature. Users can rename bots at any time, making it easier to organize strategies, track performance, and manage multiple bots within a single account.

We added support for cross-margin accounts, expanding the bot’s compatibility across spot account types.

There are now three spot account modes supported:

Previously, bots could operate only with spot original accounts — now the platform covers all three, enabling broader strategy setups and improved flexibility depending on risk preferences.

Until now, borrowing was primarily used in downside scenarios: the bot took a loan when the market declined, aiming to sell and later repurchase at a lower price.

With the new update, the platform can also borrow in stablecoins for upside scenarios. This enables a new approach:

This improvement expands strategic flexibility and supports more market conditions, including bullish momentum scenarios.

The first version of this feature is currently in active testing and refinement.

January’s updates are another step toward making ctbots.ai easier to manage, more transparent to operate, and more versatile in strategy execution. From improved UI visibility for loans and trading costs to expanded margin account support and new loan logic for rising markets, the platform continues to evolve in both usability and trading capability.

More improvements are already in progress — stay tuned for the next release as we continue refining strategy performance and expanding platform functionality.

Throughout February, we continued enhancing SSA CTP and ctbots.ai — making them more transparent, more stable, and easier to analyze.

Before we step into the new year, ctbots.ai team has been working hard on improvements. Our goal remains the same: help users grow their deposit not only in rising markets, but also during downtrends — while making the platform clearer, safer, and easier to use.

you're currently offline