Smarter tracking. Stronger stability. Greater potential — CTP and ctbots.ai February update

Throughout February, we continued enhancing SSA CTP and ctbots.ai — making them more transparent, more stable, and easier to analyze.

Crypto markets remain volatile, fast-moving, and full of opportunity and risk. In recent years, the demand for automated trading has exploded, driven by:

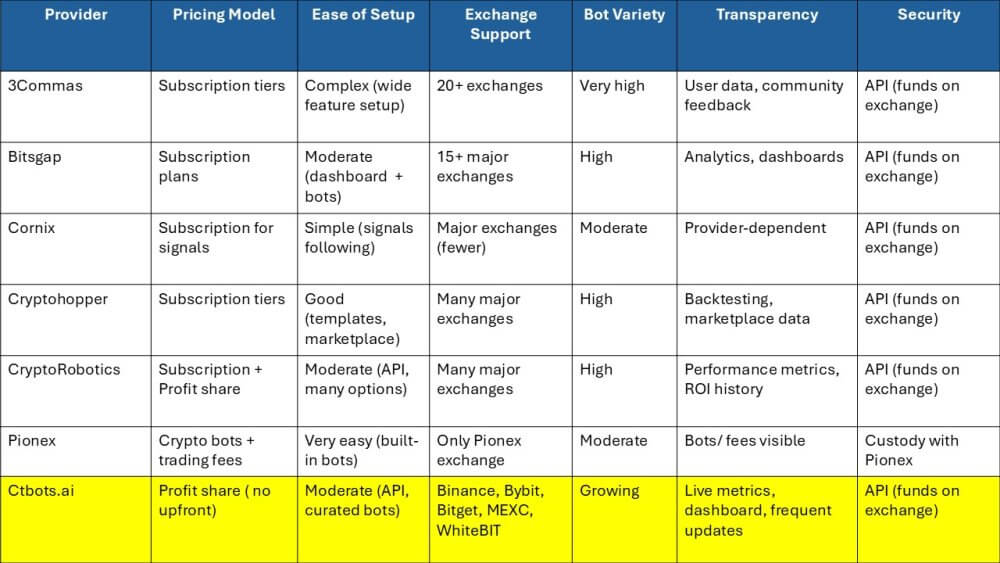

In this competitive terrain, providers differentiate based on ease of use, strategy variety, pricing model, exchange support, security & transparency, and community trust.

In this article, we compare several leading crypto bot platforms—3Commas, Cornix, Bitsgap, Cryptohopper, CryptoRobotics, Pionex—and then introduce ctbots.ai. We’ll see how ctbots.ai stacks up vs others and in what situations it might be especially appropriate.

Here are summaries of each provider, described in narrative form plus a set of feature bullet-points, to help you digest quickly what each offers.

3Commas is aimed at serious traders, offering a very broad suite of tools: bots, smart trading, signals, and a terminal. It tends to provide advanced order types (multi-take profit, trailing stop, etc.), supports many exchanges, and has a large user base. It’s mature in its offerings and is often the choice for traders who want to push automation deep.

Key features:

Strengths: Very powerful toolset, flexibility, ideal for sophisticated strategies and higher volume.

Weaknesses: Steep learning curve; costs can add up; features may differ across exchanges; risk associated with complexity.

Bitsgap markets itself not just as a bot provider but as an all-in-one trading platform: you get portfolio tools, analytics, arbitrage tools, as well as automation. Its dashboard is designed for traders who are managing multiple exchanges, multiple bots, and want a unified view. It has strategy templates, and several types of bots to match different market styles (sideways, trending, etc.).

Key features:

Strengths: Great for users who want unified control and visibility; good diversity of strategies; strong analytics.

Weaknesses: Subscription costs can be high for many bots or advanced features; may be overkill for small or occasional traders.

Cornix puts emphasis on signal providers and copy-trading. You follow someone else’s strategy, or buy signals, rather than designing bots from zero. It is simpler to use, faster to get started, but you are dependent on the signal providers’ skill and transparency.

Key features:

Strengths: Low barrier to entry; less technical setup; ideal for people wanting someone else’s insight.

Weaknesses: Greater dependence on the quality of signal providers; less control; potentially less reliable performance; transparency of signal history not always strong.

Cryptohopper is known for being highly customizable yet accessible. It’s cloud-based, so no installation is needed; you connect exchanges via API. You can buy or follow signal providers, use built-in strategy templates, backtest, and set up automated bots. It’s strong in features for both beginners and more advanced users.

Key features:

Strengths: Very customizable; proven, widely used; good for scaling up.

Weaknesses: Subscription fees regardless of performance; some features locked to higher tiers; may be more complex than simpler signal-only platforms.

CryptoRobotics is a platform offering both trading terminals and a marketplace of bots & signals. It allows you to connect your exchange accounts via API (so you keep custody) and deploy bots without needing deep coding skills. It supports spot and futures trading, displays historical bot performance, and offers different risk profiles (e.g. low, balanced, high volatility). One of the more attractive aspects is the profit-sharing model in some bots, which means less up-front cost for the user.

Key features:

Strengths: Flexible pricing, many exchanges, good transparency, multiple strategy types.

Weaknesses: Some complexity for new users, less polished than some larger incumbents perhaps; performance histories may vary across market conditions.

Pionex is more of an “exchange + built-in bots” model. Instead of being an external platform where you connect your accounts, Pionex is itself the trading venue: you deposit on Pionex, select built-in bots, and trade. This reduces friction but introduces exchange custody risk.

Key Features:

Strengths: Very simple to use; bots integrated; low cost; ideal for beginners.

Weaknesses: Limited flexibility compared to third-party bot platforms; you are locked into Pionex; advanced strategies or cross-exchange bots less available.

Ctbots.ai is a newer entrant aiming to combine strong strategy offerings, clear risk-tiers, and a profit-sharing model only so users pay only when bots perform. With a strong focus on B2B clients with 1M+ turnover, it supports multiple major exchanges, provides dashboards and monitoring, risk categories, and is actively evolving via updates.

Key features:

Strengths: Aligned incentives via profit share; risk-tier clarity; transparency; developing quickly; good for traders with moderate to high capital who want advanced bots without building from zero.

Weaknesses / Things to watch: Minimum balances required after first month; less long historical track record vs older competitors; possibly fewer bot types early on.

Here’s a table that puts these providers side by side across key attributes, so you can compare quickly.

In a market saturated with options, ctbots.ai distinguishes itself through its profit-sharing model, risk-based bot categorization, transparent live metrics, and a fast-moving development roadmap. For traders who value aligning cost with performance (i.e. only paying when bots make profits), who trade on major exchanges, and who want advanced strategies without building everything from scratch, ctbots.ai presents a compelling option.

If you are curious about automated trading or looking to move from beginner tools into more advanced automation, ctbots.ai is definitely worth exploring. Because:

Contact ctbots.ai and start your crypto trading journey with us!

Throughout February, we continued enhancing SSA CTP and ctbots.ai — making them more transparent, more stable, and easier to analyze.

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

you're currently offline