Ctbots.ai January release notes: UI widgets, cross-margin support and new loan logic

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

August has been an exciting month for ctbots.ai. Alongside powerful updates to our trading strategies, we focused heavily on system performance, stability, and user experience—ensuring that every trader enjoys a faster, smoother, and more reliable platform.

Here’s a look at what’s new:

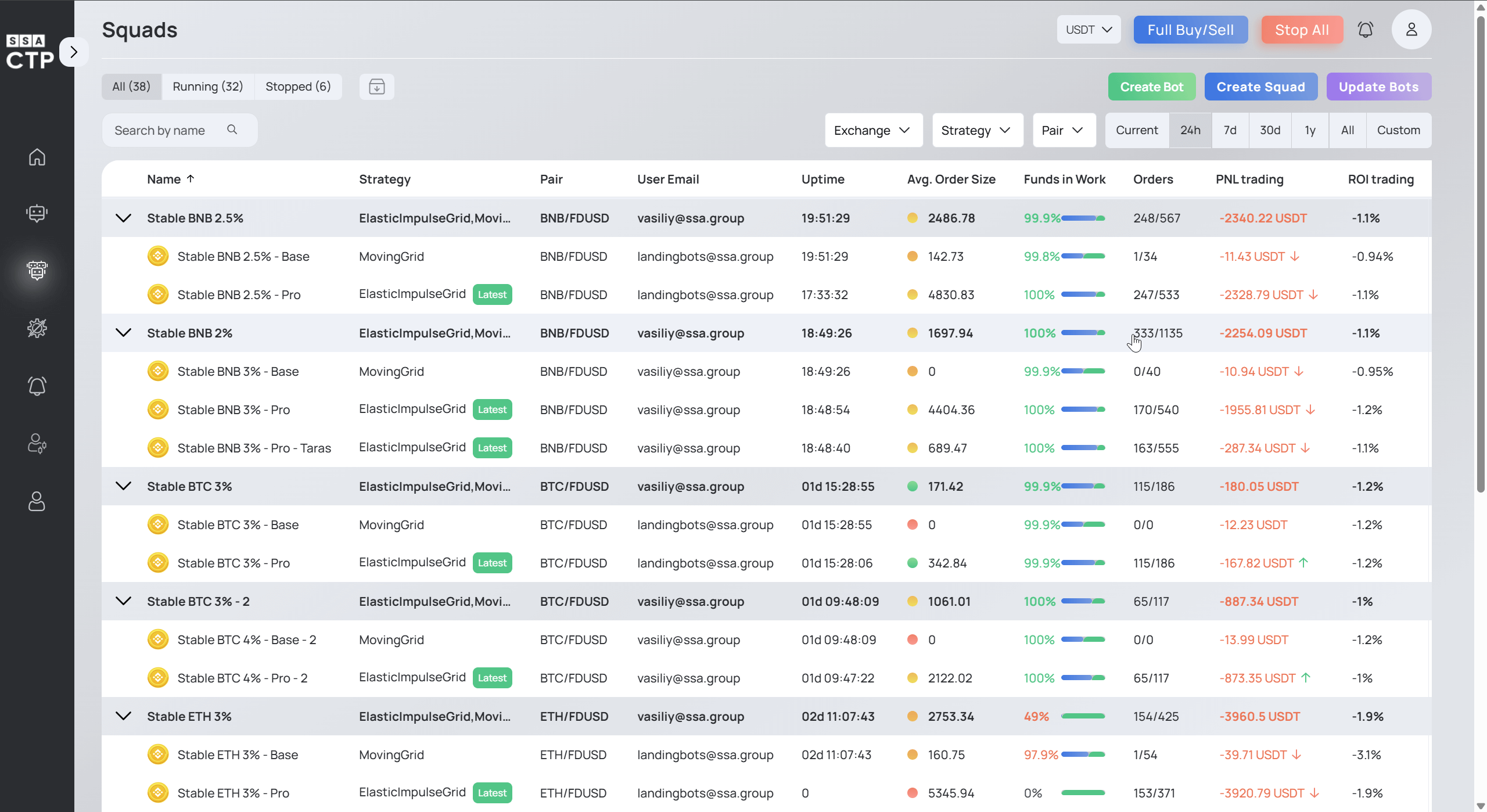

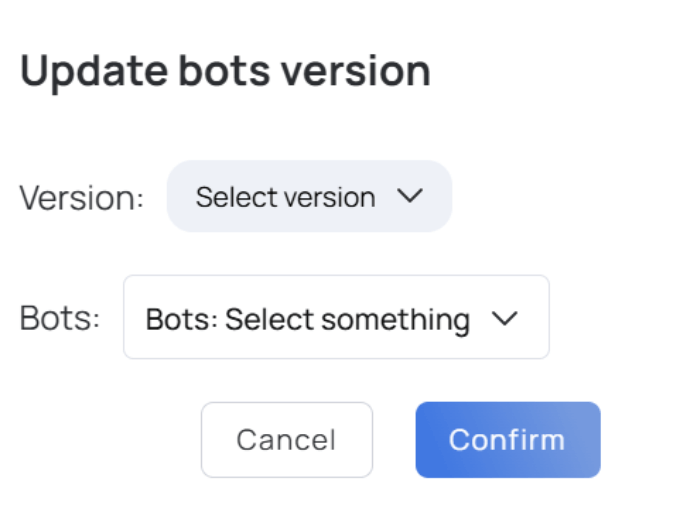

Managing bots just got easier. With the new update feature, you can now upgrade multiple bots to the latest version with just one click. Updated bots are marked with a “latest” label in the list for easy tracking.

Even better—users can switch not only to the newest release but also roll back to any previous version if needed. This flexibility makes system support and maintenance much more convenient.

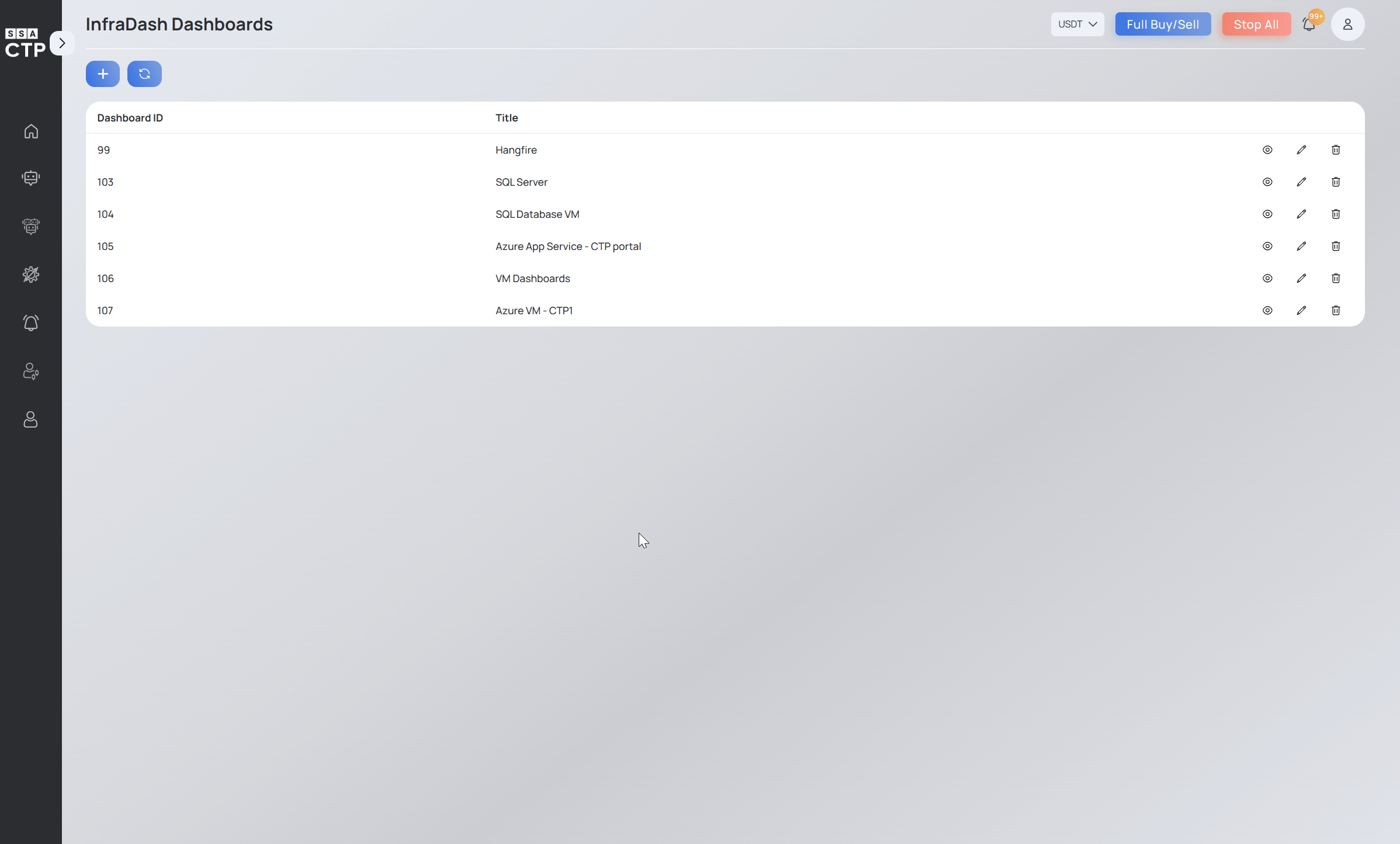

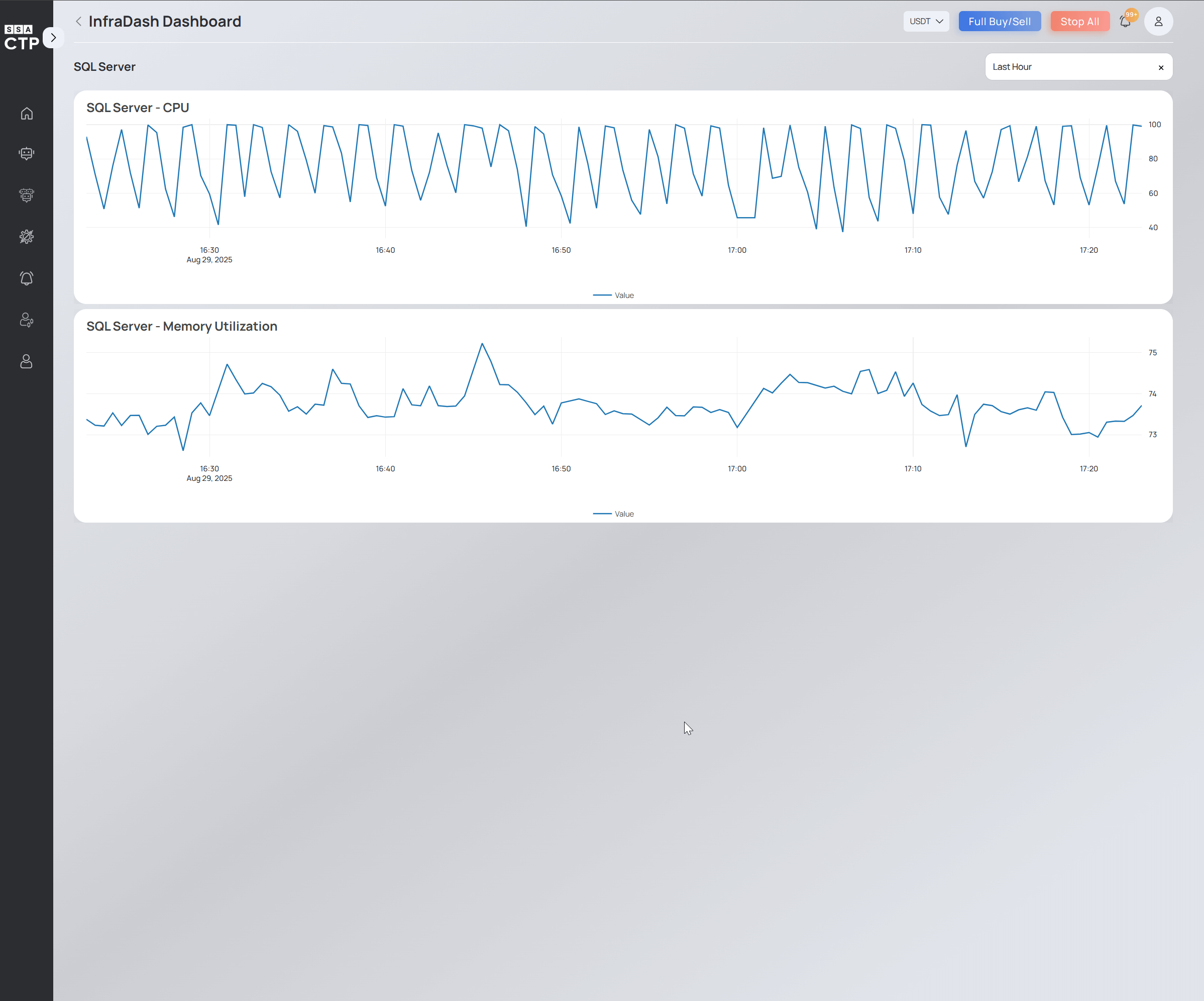

We’ve implemented InfraDash directly into the CTP portal, giving us powerful tools to monitor and maintain infrastructure quality.

This update is also the first real-world application of SSA UI kit upgrade, enhancing usability and consistency across the platform.

Building on our dynamic capital allocation, the new Root fine-tuning feature adapts bots to live market conditions more intelligently.

Here’s how it works:

An important nuance is that shifting the root upward is easier than moving it downward. This means that for the bot to shift downward, the market must show significantly stronger bearish pressure, making the adjustment both smarter and more resistant to false signals.

This ensures capital is used more efficiently, reduces waste at the edges, and maximizes ROI.

Our Stop-Loss protection mechanism, first introduced in June, has now been significantly improved. Initially, this feature safeguarded traders by triggering a sell-off when the bot detected sustained price drops—securing funds in stablecoins before a deeper decline.

With the latest upgrade, the mechanism is now faster, more responsive, and more efficient. Bots can detect bearish trends earlier, exit positions sooner, switch fully into sell mode during downturns, and then re-enter the market once conditions stabilize.

The benefits are clear:

In short, this upgrade makes the Stop-Loss system a more powerful tool for protecting capital and ensuring long-term trading performance.

The Reverse Teasing mechanism is now more intelligent and adaptive:

This fine-tuned sensitivity gives bots more control and stability across different market conditions.

We’re preparing a major User Management update that will support multiple account types—perfect for institutional organizations or teams that need different roles and access levels.

Roles will include:

This will make collaboration and professional use of ctbots.ai smoother than ever.

At ctbots.ai we’re committed to building the most advanced and user-friendly crypto bot trading platform. With each update, we’re improving strategies, boosting functionality, and giving traders the tools to maximize their success.

👉 Want to be part of the future of seamless, automated crypto trading? Join ctbots.ai today and start your journey.

Starting the year strong, we continued improving both Crypto Trading Platform (CTP) interface and the ctbots.ai strategy layer.

Before we step into the new year, ctbots.ai team has been working hard on improvements. Our goal remains the same: help users grow their deposit not only in rising markets, but also during downtrends — while making the platform clearer, safer, and easier to use.

you're currently offline